So far, your analysis of an individual company has enabled you to build up a general picture of the business, the way it’s run and its state of health. The final step is to carry out a detailed review of the company’s finances.

This may take a bit of time and effort, but it’s worth doing. Financial statements can yield all sorts of interesting quantitative data from which you can deduce the strength of the company, the effectiveness of its strategy and its prospects for the future.

So what should you look for in financial statements and how do you interpret the figures you see? In this lesson and the two that follow, we’ll run through some key areas you should include in your analysis and explain what they mean.

What is a balance sheet?

A balance sheet is a statement of the company’s assets, liabilities and capital at the end of a particular reporting period. It typically includes:

Assets

- Cash: the most liquid assets, which also include any government debt being held

- Marketable securities: equity and debt securities that can be traded on a liquid market

- Long-term securities: securities which can’t be liquidated immediately

- Inventory: goods available for sale, typically valued at their cost or market price, whichever is lower

- Accounts receivable: money owed to the company by its customers, factoring in any expectation of money unlikely to be paid

- Fixed assets: these include land, equipment and machinery

- Intangible assets: non-physical assets such as intellectual property

Liabilities

- Long-term debt: the interest and principle on corporate bonds that the company has issued

- Tax payable: taxes that will have to be paid off, although not immediately

- Pension funds: money set aside to provide for employee pensions

Shareholder equity

- Shares: the equal parts into which the company’s capital is divided, with their owners being entitled to a proportion of the profits made by the business

- Retained earnings: earnings that are subsequently reinvested in the business or used to pay off existing company debt

- Treasury shares: shares which are set aside to be used at a later date if the company needs to raise funds. This can also refer to shares that the company has bought back

The best way to interpret a balance sheet is to compare it with previous releases, looking to see which way the figures have been changing over time. You might also want to review it alongside balance sheets for other, similar companies within the industry to get a sense of what’s the norm.

From a balance sheet you can derive a number of useful ratios, such as the popular debt/equity ratio. This measures a company’s financial leverage. To find it, you divide the company’s liabilities by its shareholder equity.

Question

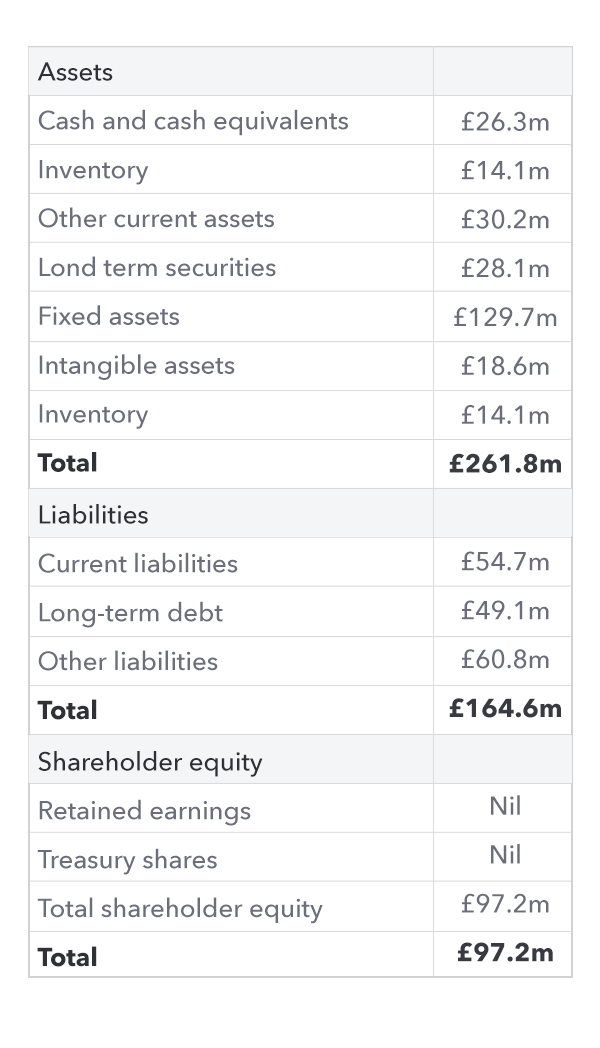

Imagine you’re analysing the financial statements for Oil Company B. The company’s latest balance sheet is shown below (simplified for clarity).

How would you calculate the company’s financial leverage?

- a £261.8m ÷ 164.6m = 1.5905 (159.05%)

- b £261.8m ÷ £97.2m = 2.6934 (269.34%)

- c £164.6m ÷ £97.2m= 1.6934 (169.34%)

Reveal answer

Now, suppose you discover that Oil Company B has a higher debt/equity ratio than its competitors.

What might this imply about the company’s strategy?

- a An aggressive approach with a higher level of risk

- b A cautious approach with a lower level of risk”